Browse other blogs

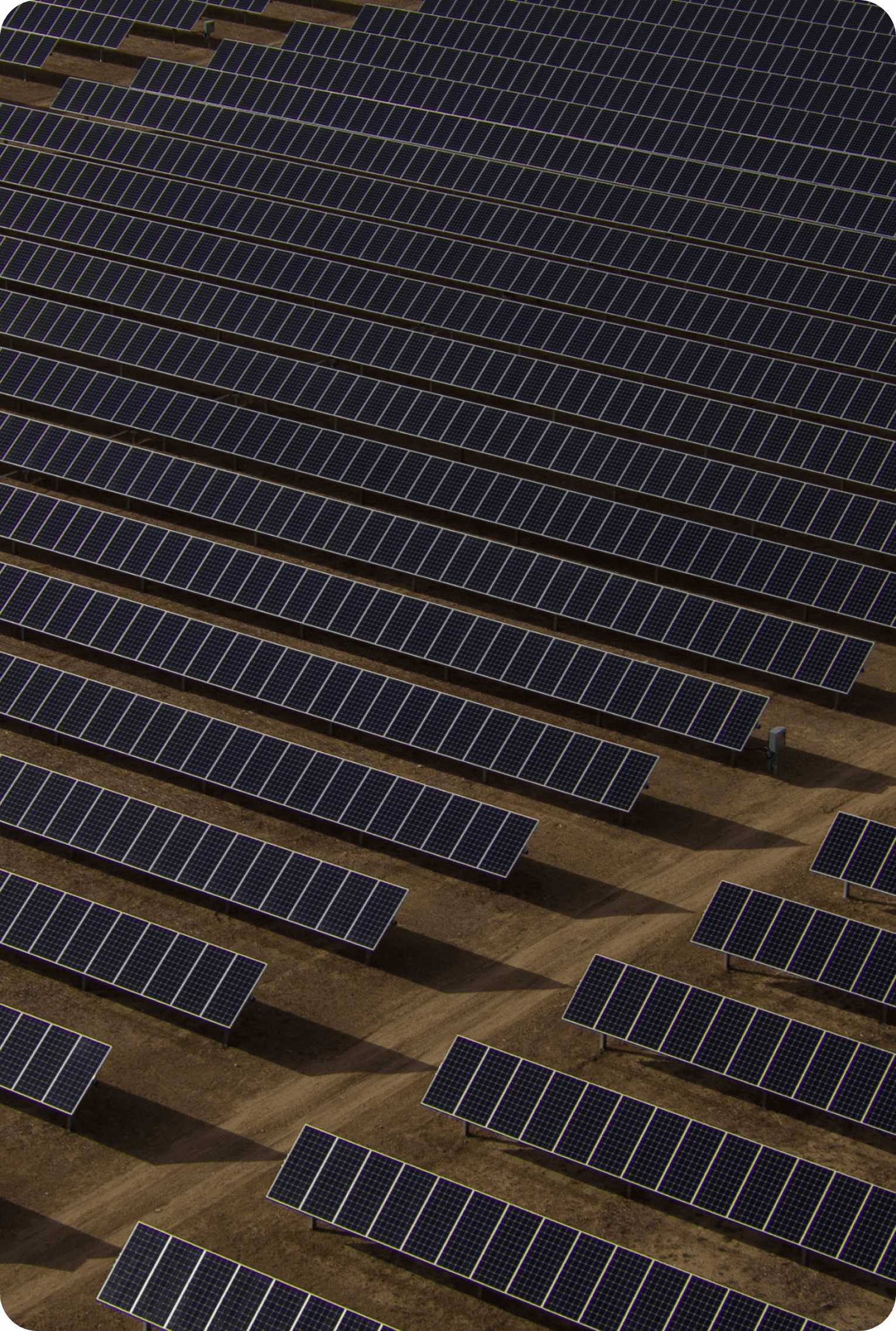

Simplify Solar Project Financial Processes with TaskMapper

Utility-scale solar projects require substantial capital investment, making efficient financial management essential. The financing process spans multiple stages, from project development and due diligence to construction monitoring and loan repayment. These steps demand multi-team collaboration and strict adherence to lender conditions to ensure timely loan disbursement. TaskMapper simplifies these complex workflows, enabling seamless coordination and real-time monitoring at every stage.

Overview of Project Finance Processes

From initial development to loan repayment, solar project developers must navigate key stages, including project proposal creation, due diligence, and loan disbursement, to secure financing. Meeting “conditions precedent” (CPs)—specific milestones set by lenders—is critical for unlocking funds.

Project Development and Proposal Creation: Developers define the project scope, assess technical and economic viability through pre-feasibility studies, and create a detailed proposal. This includes an executive summary, market analysis, technical design, financial projections, and risk assessments to demonstrate viability.

Financing Structure: Lenders specializing in renewable energy and potential equity partners are identified. Loan terms, including repayment schedules, interest rates, and covenants, are negotiated to secure debt financing.

Due Diligence and Loan Agreement: Lenders conduct rigorous reviews, including site visits and contract evaluations, to mitigate risks. A loan agreement is signed, and a security package, such as collateral or guarantees, is provided.

Loan Disbursement and Monitoring: Funds are released according to a draw schedule linked to CPs, often tied to construction milestones. Developers provide regular updates, while lenders verify progress through reports or site visits.

Repayment and Compliance: Repayment begins after the project achieves commercial operation. Asset managers ensure compliance with loan covenants, oversee reporting and maintain the project’s financial health throughout its lifecycle.

By adhering to these stages and managing CPs effectively, developers can secure financing and drive projects toward successful completion.

How Can TaskMapper Help?

The project finance process is complex, involving multiple teams and stakeholders across finance, legal, technical, project execution, and asset management. TaskMapper offers digital solutions to streamline the process.

Streamlining Due Diligence:

TaskMapper digitizes due diligence, turning complex requirements into manageable workflows. Activities like contract reviews, risk assessments, and site feasibility studies are organized using Forms and Task tools, fostering collaboration among teams. Kanban boards and calendar views visualize deadlines and dependencies, ensuring CPs are met on time. For instance, site visits by independent engineers can be planned and tracked efficiently, with documentation attached to milestones. This transparency eliminates bottlenecks that could delay financial approvals.

Overview of Project Finance Processes

From initial development to loan repayment, solar project developers must navigate key stages, including project proposal creation, due diligence, and loan disbursement, to secure financing. Meeting “conditions precedent” (CPs)—specific milestones set by lenders—is critical for unlocking funds.

Project Development and Proposal Creation: Developers define the project scope, assess technical and economic viability through pre-feasibility studies, and create a detailed proposal. This includes an executive summary, market analysis, technical design, financial projections, and risk assessments to demonstrate viability.

Financing Structure: Lenders specializing in renewable energy and potential equity partners are identified. Loan terms, including repayment schedules, interest rates, and covenants, are negotiated to secure debt financing.

Due Diligence and Loan Agreement: Lenders conduct rigorous reviews, including site visits and contract evaluations, to mitigate risks. A loan agreement is signed, and a security package, such as collateral or guarantees, is provided.

Loan Disbursement and Monitoring: Funds are released according to a draw schedule linked to CPs, often tied to construction milestones. Developers provide regular updates, while lenders verify progress through reports or site visits.

Repayment and Compliance: Repayment begins after the project achieves commercial operation. Asset managers ensure compliance with loan covenants, oversee reporting and maintain the project’s financial health throughout its lifecycle.

By adhering to these stages and managing CPs effectively, developers can secure financing and drive projects toward successful completion.

How Can TaskMapper Help?

The project finance process is complex, involving multiple teams and stakeholders across finance, legal, technical, project execution, and asset management. TaskMapper offers digital solutions to streamline the process.

Streamlining Due Diligence:

TaskMapper digitizes due diligence, turning complex requirements into manageable workflows. Activities like contract reviews, risk assessments, and site feasibility studies are organized using Forms and Task tools, fostering collaboration among teams. Kanban boards and calendar views visualize deadlines and dependencies, ensuring CPs are met on time. For instance, site visits by independent engineers can be planned and tracked efficiently, with documentation attached to milestones. This transparency eliminates bottlenecks that could delay financial approvals.

Manage financing activities like feasibility studies, contract reviews and risk assessments using centralized files, forms, and digital tasks

Accurate Construction Monitoring for Loan Disbursement:

During construction, lenders require certified progress updates for subsequent loan tranches. TaskMapper’s drone-based monitoring system replaces traditional, manual inspections with automated, high-resolution maps of the construction site. These maps provide precise progress overviews by counting installed components. By auditing the EPC's self-reported milestones, TaskMapper prevents overreporting and ensures payments align with actual progress. The platform generates detailed progress reports for lenders and independent engineers, supporting timely disbursements.

Accurate Construction Monitoring for Loan Disbursement:

During construction, lenders require certified progress updates for subsequent loan tranches. TaskMapper’s drone-based monitoring system replaces traditional, manual inspections with automated, high-resolution maps of the construction site. These maps provide precise progress overviews by counting installed components. By auditing the EPC's self-reported milestones, TaskMapper prevents overreporting and ensures payments align with actual progress. The platform generates detailed progress reports for lenders and independent engineers, supporting timely disbursements.

Digital-twin-based data and drone-based solar construction progress updates for lenders

Simplifying CP Fulfillment and Collaboration:

TaskMapper’s task management tools organize CPs into visual boards and lists, enabling teams to track tasks, set deadlines, and manage dependencies. For example, CPs like obtaining permits, completing financial modeling, or finalizing a security package are tracked in real-time. This alignment across teams reduces delays and ensures critical deadlines are met efficiently.

Simplifying CP Fulfillment and Collaboration:

TaskMapper’s task management tools organize CPs into visual boards and lists, enabling teams to track tasks, set deadlines, and manage dependencies. For example, CPs like obtaining permits, completing financial modeling, or finalizing a security package are tracked in real-time. This alignment across teams reduces delays and ensures critical deadlines are met efficiently.

Project financing and lender CP management with forms, workflows, tasks, dashboards, and more

Integrated Financial Reporting and Compliance:

TaskMapper centralizes project data, simplifying ongoing financial reporting. Compliance with loan covenants and financial health metrics like DSCR levels is tracked and accessible. Asset managers can leverage the digital twin feature to monitor asset performance, generate reports, and maintain transparent communication with lenders.

Simplified construction progress reporting, transparent communication, and centralized data for financial reporting

With TaskMapper, your solar project financing transforms into an efficient, transparent, and collaborative process. TaskMapper integrates workflows, drone-based monitoring, and advanced reporting into a single platform to streamline CP management, enable construction monitoring, and ensure financial compliance.

With TaskMapper, your solar project financing transforms into an efficient, transparent, and collaborative process. TaskMapper integrates workflows, drone-based monitoring, and advanced reporting into a single platform to streamline CP management, enable construction monitoring, and ensure financial compliance.

To know how SenseHawk's TaskMapper platform can deliver next-gen construction and operations monitoring and management to connect your teams, drive efficiency improvements, and optimize processes, drop an email to contact@sensehawk.com.

Read More

To know how SenseHawk's TaskMapper platform can deliver next-gen construction and operations monitoring and management to connect your teams, drive efficiency improvements, and optimize processes, drop an email to contact@sensehawk.com.

Read More

We believe the SenseHawk digital workflow solution for our operating sites will result in substantial productivity gains for our O&M team. It is the type of innovation essential for scaling renewables.

Abhijit Sathe | Co-CEO

SB Energy

We believe the SenseHawk digital workflow solution for our operating sites will result in substantial productivity gains for our O&M team. It is the type of innovation essential for scaling renewables.

Abhijit Sathe | Co-CEO

SB Energy

We believe the SenseHawk digital workflow solution for our operating sites will result in substantial productivity gains for our O&M team. It is the type of innovation essential for scaling renewables.

Abhijit Sathe | Co-CEO

SB Energy

Posted by

Team SenseHawk

Related Tags

Posted by

Team SenseHawk

Related Tags

Posted by

In the news

TaskMapper Solar

Products

TaskMapper Solar

Products

TaskMapper Solar